Holding companies provide a strategic option for entrepreneurs and investors to manage a business, orchestrating operations from behind the scenes without the need for direct day-to-day involvement.

This type of business structure can be powerful when you’re looking to manage multiple businesses. But what does a holding company involve? Let’s cover everything you need to know, how it works, its benefits and how to set up a holding company in Australia.

What is a holding company?

A holding company is a business entity created to own shares and manage other companies under its control, subsidiary companies. In Australia, holding companies, like all other types of companies, are governed by the Corporations Act 2001 (Cth).

Different from a traditional trading company, a holding company doesn’t usually offer direct products or services and doesn’t get involved in the day-to-day operations of a business. They are commonly used to manage company investments and expenses, oversee subsidiary companies and protect assets.

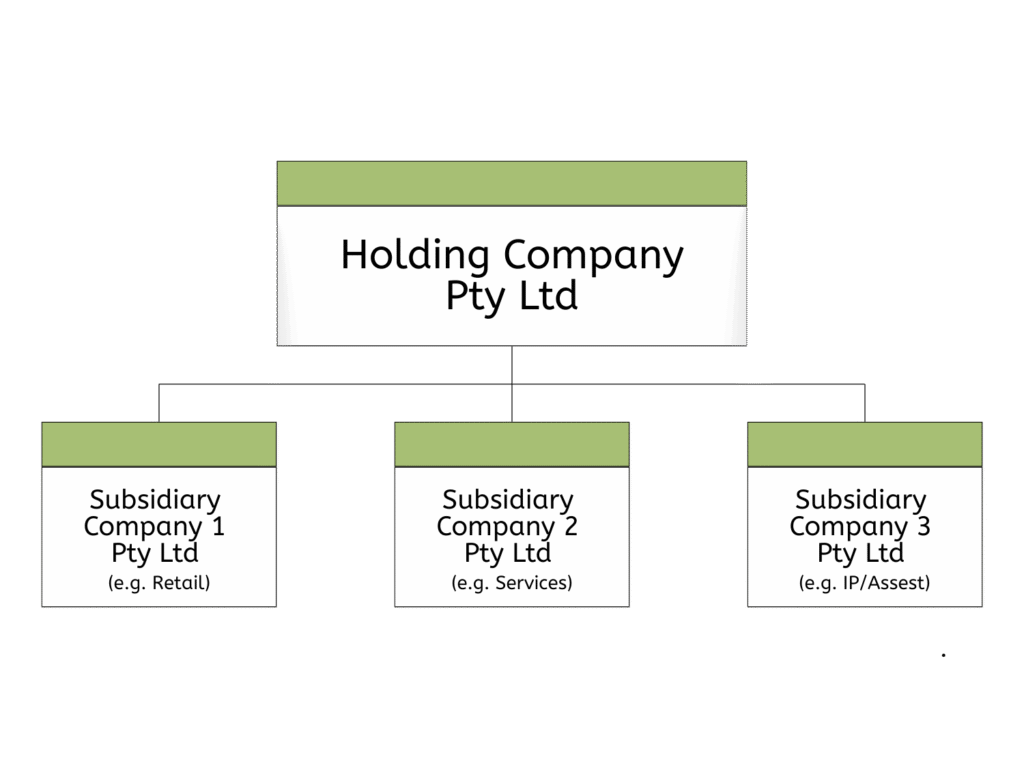

A simple way to explain it is, for example, imagine the holding company is a parent of a family of businesses, each runs different activities independently.

Subsidiary companies

A subsidiary company, then, is a company (which often trades as a business) that is owned in part or whole by a different company (usually a holding or parent company). However, it is still a separate legal entity that pays its own taxes and handles its own debts.

The holding or parent company naturally influences the subsidiary company’s operations, including governance decisions, while helping to limit liabilities between the companies.

For example, a simple holding company structure may look like this:

Why create a holding company?

Forming a holding company offers several benefits that can significantly enhance your business’s protection and growth potential. Let’s explore some key benefits:

Centralised management

→ a holding company enables unified management of multiple subsidiary companies, ensuring consistent decision-making and streamlined coordination across the group.

Access to capital and investment opportunities

→ by pooling the assets and cash flows of subsidiary companies, a holding company can efficiently fund investments or acquisitions, and manage resource allocation across the group.

Tax efficiency

→ your accountant or tax specialist can explain how holding company structures can help to optimise tax outcomes.

Ownership of multiple businesses

→ a holding company is a straightforward way to own and manage multiple entities through a single corporate structure, simplifying ownership and oversight.

Risk management and growth flexibility

→ if one subsidiary encounters financial or legal trouble, it doesn’t directly impact the others. This can help to significantly reduce your business risk. In addition, a holding company structure can assist with business expansion, acquisitions, and succession planning.

Disadvantages of a holding company

Common disadvantages of this type of company structure are:

Administration challenges

→ Managing multiple subsidiaries can be complicated and time-consuming, sometimes making it difficult to track performance across all entities.

Potential for conflicts of interest

→ Conflicts can arise between the objectives, particularly if subsidiaries have minority shareholders who may feel their interests aren’t adequately represented.

Regulatory and compliance issues

→ Operating across multiple jurisdictions and industries can increase regulatory complexity, requiring specialised knowledge and ongoing attention.

How to set up a holding company (step-by-step)

1. Choose the company name and business structure:

- select the appropriate legal structure and choose your company name (check its availability using the ASIC Registry Search); and

- decide the shareholders and the number or percentage of shares each will hold.

2. Select the company address and the state/territory of registration:

- choose which Australian state or territory your company will be registered in; and

- provide a registered office address and a principal place of business address in Australia (the principal place of business address can often be the same as the registered office address).

3. Appoint responsible officers:

- assign at least one director who is an Australian resident, a company secretary and a resident public officer for tax purposes (these roles can often be fulfilled by a single person); and

- obtain written consent from all office holders and members (shareholders) before proceeding.

4. Prepare required documentation:

- draft a company constitution; and

- prepare a statement of capital, memorandum and articles of association.

5. Apply to register your company:

- submit your application to ASIC, providing all required information, including:

– company name;

– office address/es;

– details of the responsible officer/s

– shareholder/s; and

– supporting documents. - pay the registration fee and wait for ASIC’s review.

6. Obtain ABN & open a bank account:

- apply for an Australian Business Number (ABN); and

- open a dedicated bank account to ensure financial independence from your subsidiaries.

7. Acquire subsidiaries:

- Once ASIC accepts your application and registers your company, your holding company can acquire shares in other companies, including purchasing existing businesses or establishing new subsidiaries.

8. Stay compliant:

- maintain up-to-date records;

- notify ASIC of any changes within 28 days; and

- ensure compliance with all legal and tax obligations.

Costs of setting up and maintaining

ASIC sets fees related to the registration of companies. These fees are updated annually on 1 July. Some of the current registration and maintenance fees for 2025 include:

- registering a proprietary limited company: $611.

- reserving a new company name: $62.

- annual review fee: $329.

Additional costs may arise for registering necessary business licenses or permits, depending on your activities. Plus, if you miss a deadline or forget a lodgement, ASIC may charge an extra fee.

Other setup expenses to consider:

- auditing (if required by company size or structure);

- tax return preparation and lodgement;

- legal or accounting services; and

- registered office expenses.

Read about “Ultimate Guide for ASIC Fees 2025”

H+A Legal, your trusted partner in business structuring

Getting the structure right from the start can save you substantial time, money and headaches down the track. Being informed then becomes crucial to building a solid foundation for business success.

At H+A Legal, we specialise in helping Australian businesses navigate the intricacies of business law. Our team can assist with:

- business structuring;

- drafting and reviewing business contracts;

- share sales and other key business transactions; and

- commercial disputes.

Get ongoing support for business structuring needs and the legal complexities that arise as your business grows and evolves.